Laptop depreciation rate calculator

You may be able to deduct the acquisition cost of a computer purchased for business use in several ways. You can use this tool to.

Depreciation Rate Formula Examples How To Calculate

Answer 1 of 2.

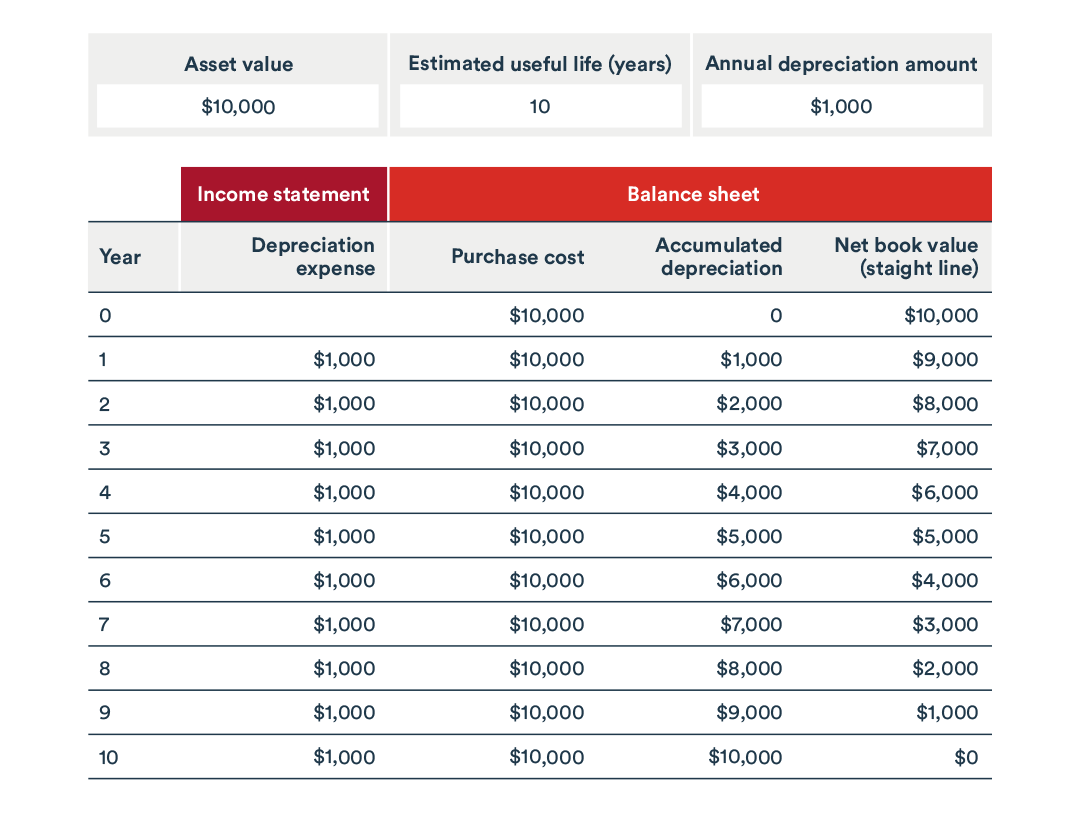

. You can set up columns for the following Historical Value Residual Value Useful Life and Accumulated Depreciation. Before you use this tool. Not Book Value Scrap value Depreciation rate Where NBV is costs less accumulated depreciation.

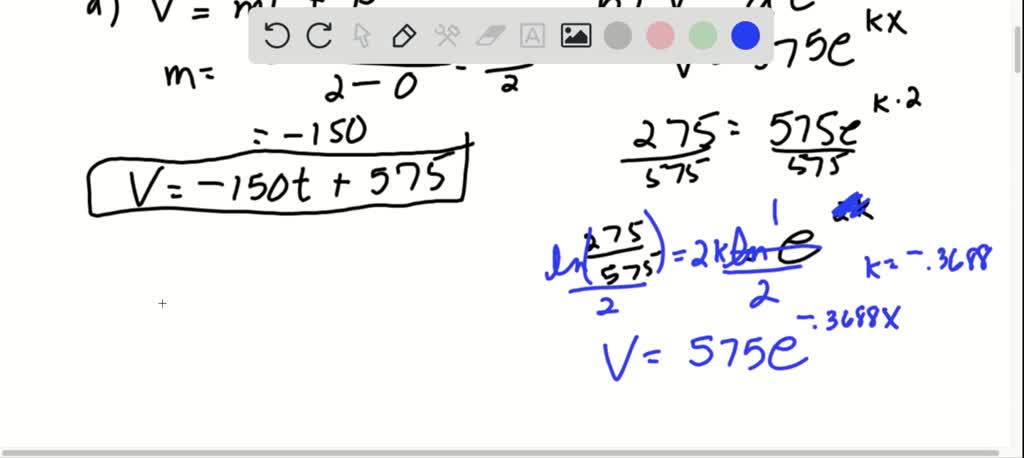

The formula to calculate depreciation through the double-declining method is. Software in Class 12 is subject to the half-year rule. Then depreciate 515 of the assets cost the first year 415 the second year.

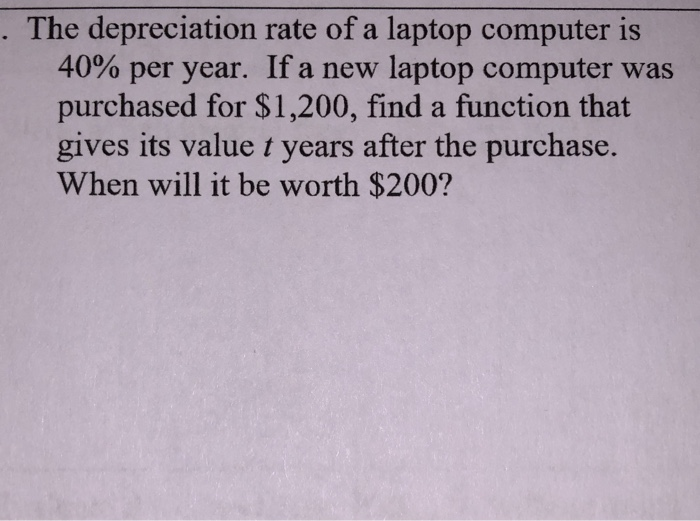

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3. The computer will be depreciated at 33333 per year for 3 years 1000 3 years. Find the depreciation rate for a business asset.

Include in Class 12 with a CCA rate of 100 computer software that is not systems software. Rate of Depreciation on Computer Computer Software Laptops and Keyboard - 40. Diminishing Value Rate Prime Cost Rate Date of Application.

Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable Computers including laptops and. 264 hours 52 cents 13728. Calculate depreciation for a business asset using either the diminishing value.

Easiest way to do this is through excel. The rate or percentage at. Depreciation Amount Asset Value x Annual Percentage.

Depreciation rate finder and calculator. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual.

What is the depreciation period and rate for business. SYD depreciation Method Yearly Depreciation Value remaining lifespan SYD x. The tool includes updates to.

Under Internal Revenue Code section 179 you can expense the acquisition. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. If the computer has a residual value in 3 years of 200 then depreciation would be calculated.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Calculate the CCA for.

Diagnostic measuring and testing assets. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. ATO Depreciation Rates 2021.

First add the number of useful years together to get the denominator 1234515.

Salvage Value Formula Calculator Excel Template

10 Key Tax Deductions For The Self Employed

Download Depreciation Calculator Excel Template Exceldatapro

Surface Laptop Studio Review Redefining What A Windows Laptop Can Be Again Windows Central

What Is Depreciation Types Examples How To Calculate Depreciation Jupiter

Top 3 Online Depreciation Calculator To Calculate Depreciation

Calculating Depreciation How It S Done Ionos

Depreciation Rate Formula Examples How To Calculate

Startup Burn Rate Calculator Calculate Your Runway Pilot Blog

Solved The Depreciation Rate Of A Laptop Computer Is 40 Chegg Com

How To Calculate Depreciation Legalzoom

Depreciation Formula Calculate Depreciation Expense

Solved A Laptop Computer That Costs 575 Dollars New Has A Book Value Of 275 Dollars After 2 Years A Find The Linear Model V M T B B Find The Exponential Model V A E K X

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Income

How To Calculate Depreciation Know Your Assets Real Value

How To Calculate Depreciation

What Is Amortization Bdc Ca