Black scholes calculator

Long Call bullish Calculator. To calculate a basic Black-Scholes value for your stock options fill in the fields below.

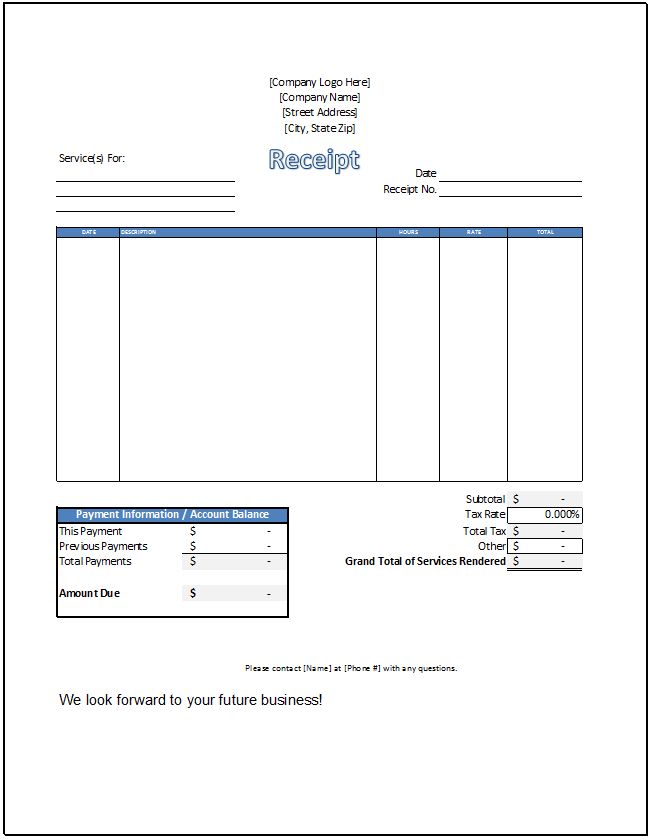

Accounts Receivable Analysis Accounts Receivable Project Management Templates Bookkeeping Templates

This calculator is a great way of cutting back on your energy use and saving on your electricity bills.

. Black Scholes Formula. Tuesday 9th of November 2021 - 0836 PM Pacific Time PT. Out of the two the Black Scholes model is more prevalent.

You can use our calculator above which uses the Black Scholes formula to estimate the value of a long call. Brokerage calculator Margin calculator Holiday calendar. Purchasing a call is one of the most basic options trading strategies and is suitable when sentiment is strongly bullish.

The Black Scholes model also known as the Black-Scholes-Merton model is a model of price variation over time of financial instruments such as stocks that can among other. Input what you pay for. Volatility Interest Dividend.

Using the Black and Scholes option pricing model this calculator generates theoretical values and option greeks for European call and put options. The Black-Scholes options pricing model only applies to European options. The options calculator is based on the Black.

The Black Scholes calculator allows you to estimate the fair value of a European put or call option using the Black-Scholes pricing model. This electricity cost calculator works out how much electricity a particular electrical appliance will use and how much it will cost. S underlying price per share K strike price per share σ volatility pa r continuously compounded risk-free interest rate pa q continuously compounded.

Dilip kumarJanuary 31st 2012 at 305am. Black Scholes Option Pricing Formula. The Black.

Remember that the actual monetary value of vested stock options is the difference between the market price and your exercise price. The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the Black-Scholes or Binomial Tree pricing modelThe binomial model is most appropriate to use if the buyer can exercise the option contract before expiration ie American style options. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

There are two primary models used to estimate the pricing of options Binomial model and Black Scholes model. It also calculates and plots the Greeks - Delta Gamma Theta Vega Rho. Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option.

Enter your name and email in the form below and download the free template now. Xlf-black-scholes-codetxt 4 KB Development platform. PeterJanuary 31st 2012 at 206am.

Black Scholes Model. The Black Scholes option calculator will give you the call option price and the put option price as 6567 and 930 respectively. The History of the Black-Scholes Model.

For example if a stock currently trades at 40 and an. This lets us find the most appropriate writer for any type of assignment. Fischer Black Myron Scholes and Robert Merton won the Nobel Prize.

Download the Free Template. Stock Options. Black Scholes model assumes that option price can be determined by plugging spot price exercise price time to expiry volatility of the underlying and risk free interest rate into Black Scholes formula.

It can be used as a leveraging tool as an alternative to margin trading. You can open the VBA editor to see the code used to generate the values. Option Greeks are option sensitivity measures.

Both models are based on the same theoretical foundations and assumptions such as the geometric Brownian motion theory of. The data and results will not be saved and do not feed the tools on this website. From the parabolic partial differential equation in the model known as the BlackScholes equation one can deduce the BlackScholes formula which gives a theoretical estimate of the price of.

Black Scholes modelformulaequation is very complicatedSome calculator based on it is very usefulUsing this calculatorI have observed somethingI have taken data like thisCall optionspot price110strike price100risk free interest10expiry time30 daysimplied volatility30but it reduces daily 1All datas are imaginariesOnly. It is also written on the Black Scholes page. The Black-Scholes model gets its name from Myron Scholes and Fischer Black who created the model in 1973.

The model is sometimes called the Black-Scholes-Merton model as Robert Merton also contributed to the models development. Option price is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate option trader needs to know how the changes in these variables affect the option price or. Assumptions and limitations of the Black Scholes Model Like all models it is essential to accept the Black Scholes models results as estimations that should guide your decision-making not as absolutes.

Hi please give example. According to the Black-Scholes option pricing model its Mertons extension that accounts for dividends there are six parameters which affect option prices. Black Scholes Calculator.

This Black Scholes calculator uses the Black-Scholes option pricing method to help you calculate the fair value of a call or put option. Here is a brief preview of CFIs Black Scholes calculator. The implied volatility can be fetched from the option chain from the NSE.

The BlackScholes model develops partial differential equations whose solution the BlackScholes formula is widely used in the pricing of European-style options. C call option price N CDF of the normal distribution St spot price of an asset K strike price r risk-free interest rate t time to maturity σ volatility of the. You can see the code in the spreadsheet.

The BlackScholes ˌ b l æ k ˈ ʃ oʊ l z or BlackScholesMerton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. How to use this calculator. Black Scholes on the HP10bII financial calculator.

Options are purchased by investors when they expect the price of a stock to go up or down depending on the option type. Microsoft Excel 2013 Pro 64 bit. Bs_nondivxlsm 29 KB Download the VBA code for this module.

Alternatively you can look at the examples on the black scholes model page. The Black-Scholes model and the Cox Ross and Rubinstein binomial model are the primary pricing models used by the software available from this site Finance Add-in for Excel the Options Strategy Evaluation Tool and the on-line pricing calculators. Black-Scholes Option Pricing Calculator.

The popularity of the Black Scholes model can be estimated from the fact that the developer of this model. Download the Excel file for this module. The interest rate in the B.

Toggle navigation Option Calculator. The Greek is used in the name because these are denoted by Greek letters. Z-Connect blog Pulse News Circulars Bulletin IPOs.

Excel Optimal Hedging Strategy Template Optimization Risk Aversion Excel Templates

Good Documentary About The Black Scholes Formula Documentaries Best Documentaries Finance

Como Calcular Porcentagem Do Total Na Hp12c 2 Exemplos Praticos E Faceis Hp 12c Matematica Financeira Formulas Matematica

Black Scholes Model Options Calculator Implied Volatility Premium Calculator Financial Instrument

Conditional Value At Risk Cvar Education Excel Risk Management

Delta Neutral Option Strategies Option Strategies Strategies Option Trading

Options Premium Calculator Using Black Scholes Model Excel Sheet Premium Calculator Implied Volatility Workbook

The Hidden Cost Of Extending Option Exercise Periods Avc Start Up Got Quotes Investing

Callable Bond

Options Trading Strategies For Consistent Monthly Income

Black Scholes Model European Business Tools Price Model Model

Purchase Order Template Purchase Order Template Templates Purchase Order

Economic Value Added Eva

Digital Options Synonyms Binary Options All Or Nothing Options Cash Or Nothing Options Asset Or Nothing Options Pays A Set Payoff Options Market Options

Volatility Calculator Template Chart Calculator Business Tools

Service Receipt Template Receipt Template Cleaning Schedule Templates Templates

Vintage Electronics Calculator Pocket Calculators